Exploring the crypto world can be tough, but choosing between mining and staking is a big decision. I’ve been curious about digital currencies and faced this choice myself. Should I go for mining rigs and hashing power, or stick with staking my crypto assets? The right choice depends on knowing the key differences and benefits of each.

Key Takeaways

- Cryptocurrency mining and staking are two distinct methods of earning rewards in the crypto ecosystem.

- Mining involves using computational power to validate transactions and add them to the blockchain, while staking involves locking up your crypto assets to help validate transactions.

- Each approach offers its own set of benefits, risks, and technical requirements that must be carefully considered.

- The choice between mining and staking ultimately depends on your investment goals, risk tolerance, and technical expertise.

- Thoroughly understanding the pros and cons of each method will help you make an informed decision that aligns with your personal and financial objectives.

Understanding Cryptocurrency Mining vs Staking: Basic Concepts

In the world of cryptocurrencies, mining and staking are two main ways to earn rewards and validate transactions. Knowing the differences between these methods is key for anyone wanting to join the crypto world.

What is Proof of Work (PoW) Mining?

Proof of Work (PoW) mining uses powerful computers to solve hard math problems. These computers, like GPUs or ASICs, help add new transactions to the blockchain. Miners who solve these problems first get new cryptocurrency tokens, making crypto mining profitability a big deal for those setting up rigs.

What is Proof of Stake (PoS)?

Proof of Stake (PoS) is different. It requires users to hold a certain amount of cryptocurrency to validate transactions. Instead of solving math problems, validators are chosen based on how much cryptocurrency they hold. Cryptocurrency staking rewards are given out based on how much they stake, making it a good way to earn passive income.

Key Differences Between Mining and Staking

The main differences are in hardware needs, energy use, and rewards. Mining needs special and expensive equipment and lots of electricity. Staking can be done with a regular computer and uses less energy. Mining can offer higher rewards but comes with higher risks due to the cost of mining rig setup and ongoing expenses.

Choosing between mining and staking depends on your resources, risk level, and the cryptocurrencies you want to support. Understanding these basics helps you decide the best way to earn rewards in the crypto world.

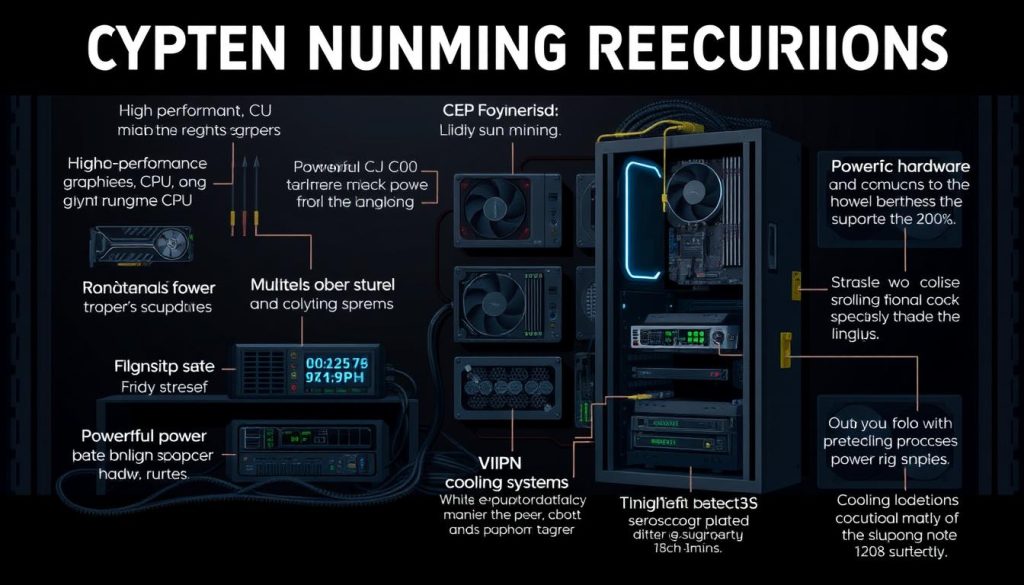

Essential Hardware Requirements for Mining Success

Starting a successful cryptocurrency mining journey needs careful thought about the necessary hardware. It’s important to choose between GPU and ASIC mining equipment. Also, power supply and cooling systems play a big role. This section will explore the technical details that are vital for your mining success.

GPU vs ASIC Mining Equipment

Choosing between GPU and ASIC mining equipment is a big decision. GPUs are flexible and can mine many cryptocurrencies. But, ASICs are made for mining specific coins and are more efficient. Knowing the pros and cons of each is key to making your mining operation better.

Power Supply and Cooling Systems

Powering and cooling your mining rigs is essential. You need high-wattage power supplies and strong cooling systems. This ensures your equipment runs well and efficiently. Managing energy consumption mining well can greatly improve your profits.

Mining Software Solutions

Finding the right mining software can be hard. But, the right tools can make your mining better. Look at the features and compatibility of different software. This can help you use your mining hardware requirements better and increase your mining efficiency.

| Mining Hardware | Advantages | Disadvantages |

|---|---|---|

| GPU Mining |

|

|

| ASIC Mining |

|

|

“Selecting the right mining hardware requirements is key to your cryptocurrency mining success. It’s all about finding the right balance between efficiency, cost, and future-proofing to maximize your returns.”

The Complete Guide to Cryptocurrency Staking

In the world of cryptocurrency, passive income staking is a new way to earn money. It’s different from mining because it doesn’t use a lot of energy. This guide will explain how to start staking, its benefits and risks, and the role of staking validators.

To start, you need to hold a certain cryptocurrency in a digital wallet. Then, you lock it up for a set time. This locked-up cryptocurrency helps verify transactions and add new blocks to the blockchain. You get a share of the transaction fees or new coins as a reward.

Staking is great because it lets you earn money without needing a lot of investment or energy. It’s also easier to start than mining, making it more accessible. Plus, staking is better for the environment because it uses less energy and power.

But, staking has its own risks. You could lose some of your staked funds if you don’t validate transactions correctly or if the network has problems. It’s key to research the staking requirements and risks of the cryptocurrency you’re interested in.

Another option is to become a staking validator. Validators verify transactions and add new blocks to the blockchain. They get rewarded for their work. To be a validator, you need to meet certain hardware and software needs, and stay online to keep the network stable.

In conclusion, cryptocurrency staking is a great chance to earn passive income. It helps make blockchain networks more secure and decentralized. By understanding the process, benefits, and risks, you can decide if staking is right for you.

Profitability Analysis: Mining vs Staking Returns

When looking at mining versus staking, it’s key to understand what affects your earnings. The return on investment (ROI) for mining and the rewards from staking give you important clues. These insights can guide you in choosing the best option for your investment.

ROI Calculations for Mining Operations

The success of mining depends on your equipment’s efficiency, electricity costs, and the mining difficulty. By examining your mining setup, you can guess your earnings. Also, joining decentralized mining pools can spread out your risk and possibly boost your earnings.

Staking Rewards and Yield Projections

Staking is a more laid-back way to invest. Your earnings from staking depend on the network’s APY and how long you keep your assets staked. Looking into the staking rewards and yield for different coins can show you the possible returns on your investment.

Risk Assessment Factors

It’s vital to weigh the risks of mining and staking. Mining needs a big investment in hardware and electricity. Staking, though less demanding, has its own risks like network stability and protocol changes. Understanding these risks helps you choose wisely based on your goals and comfort with risk.